Hello there. This is a monthly newsletter from Together. Our aim is to help entrepreneurs and founders realise their potential.

What can we promise you from this newsletter?

It will be fun and smart.

It will not take too much of your time. We know you have a lot to do.

Today, we talk about pricing. If this is the first time you’re reading our newsletter, we suggest you run through our back catalogue. There are some interesting guests there.

How do you price your product?

It’s complicated. That’s the best way to describe pricing when it comes to SaaS companies. Sure, there are your peers who price a piece of software in a certain way. But what if you’re making a breakthrough product? For it, you need to create a need. Once a need is created, you have to find a way to get your customers to part with money.

Pricing is important and requires a lot of thought. It is not just a direct measure for revenue. It also affects churn, retention, and growth. If you’re a venture-funded business, all of these are KPIs of your business that help you raise capital, grow faster, and take risks. Reports indicate that founders don’t spend enough time on pricing. Undercharging can give your customers an impression that there isn’t enough value in the product or service. And obviously, you’re reducing your potential to make money. Overcharging may make it difficult to upsell. It may also eliminate the right customer.

So, we spoke to experts. People who could help us untangle the world of pricing. Tugce Erten and Keerthana Sivakumar. Both have spent years pricing SaaS products and are, luckily for us, at Freshworks.

We asked them a few questions. We took some liberties here, we’re not going to lie. We’ve noticed that companies, especially those focussed on PLG, toy with the freemium model. Customers these days love freemiums and they pay for new features and insights. All our questions were with this in mind.

It is all about TAM 🎩

Tugce has noticed the freemium trend as well. She believes that the primary reason to do this is land grabbing. Think of this as going fishing. You need a body of water with a large number of fish. You cast your net and then you wait. Once you know you’ve hit a certain number of them, you pull them to the shore. The “free” way of doing it follows a similar principle. But why this route?

“It really gives founders a dream. If we can offer a product for free, then our TAM will go from ten people to 1,000 people,” Tugce says. This is important. Let’s go back to our fishing metaphor. This helps founders zoom in on large catchment areas. And then founders can narrow it down to the kind of fish they want.

Once founders have found the kind of customers they want, they can start discussing monetizing them.

“And as founders develop their standard personas, they need to figure out who's going to pay and who's not going to pay and who has a bigger wallet and who they should target,” she adds.

It works to give out the software for free in the initial stages. “But if you're in the position where the cost of software is not as expensive, then the marginal cost is also not that expensive,” she adds.

So, what is this magical number? When can founders know that they have reached the watershed moment? “There is, however, no magical benchmark I can offer,” says Tugce. Founders need to look at their companies, their revenue aspirations, and the growth in free users while making the decision.

“In order to disrupt a market, you have to have those initial critical points of adoption. So we are seeing a significant amount of software being launched as free products,” Tugce Erten

Build the paywall 🧱

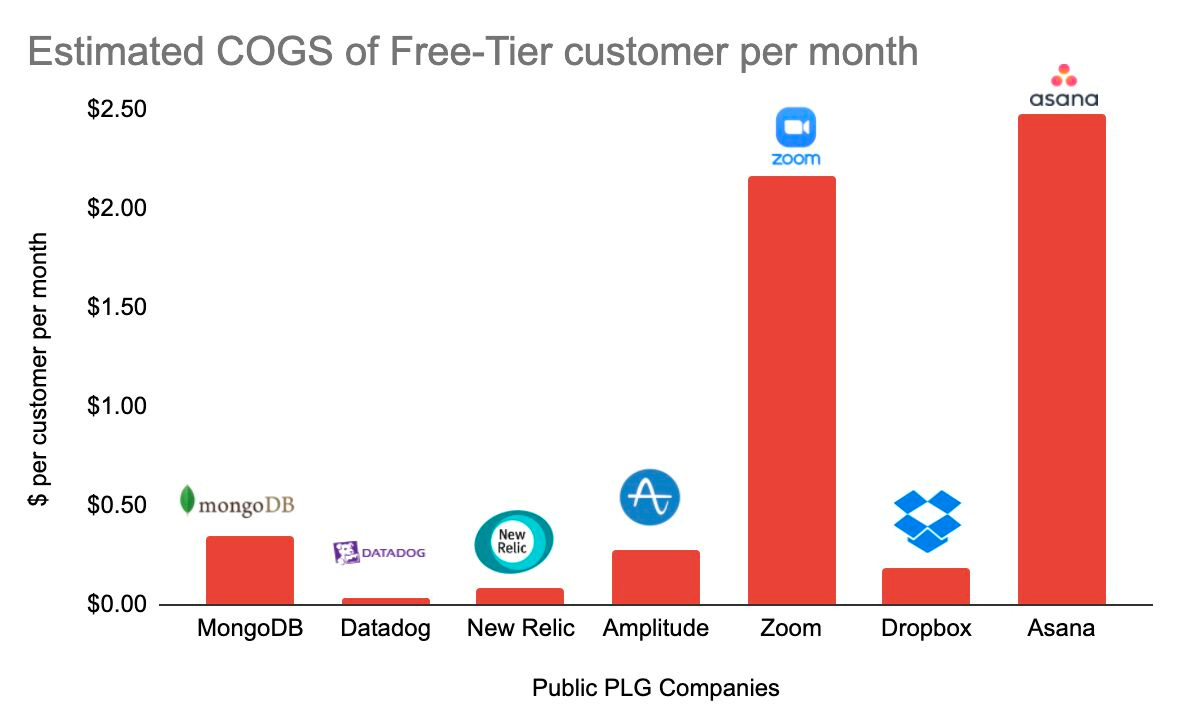

It is important to figure out how to get people to pay. There needs to be a trigger. A compelling reason. Rez Khan says that according to his research less than 5% of free users convert to paid users. Founders hence believe that free users are “cost centres”. That’s short-term thinking. He explains in this post that there are gains companies make by offering a free tier outstrip if all of these users were monetized earlier.

But there is a little nuance that Rez mentions that many gloss over. The unit of pricing.

Keerthi explains that founders need to be clear on what the billing unit should be. “And the founder should be more systematic on how they want to bill that unit?”

To answer this question, founders need to go back to the free users. The early adopters. The free tier isn’t just about acquiring mind share, Tugce says, it is about insights. “Ask the customer, ‘hey, how would you like to pay for this?’”. The answer will tell you what’s the next step for you.

“Pricing is really the lever to achieve business goals”, Keerthana Sivakumar.

“You could run a conjoint analysis. This is a pretty standard marketing pricing tool,” says Tugce. But again, in order to run a conjoint analysis, you have to have customers that are willing to answer the questions that you're asking them.

What conjoint analysis does is it forces founders to do trade-offs between features and price points. It basically answers the question: what is this feature worth and where should it go?

But this is if you want just one pricing. It’s simple. People pay or don’t pay. For early-stage startups, Tugce says, it is a good way to get going.

But there is another way. You offer tiered pricing.

“I would say don't have more than five. That's like too many already. Don't have less than three. That is too few,” says Tugce.

Tiered pricing allows founders to cluster customers into groups based on what they need.

There is also usage-based pricing but both Tugce and Keerthi agree, it doesn’t work all the time. Most customers like predictability. Usage-based pricing eliminates that from the picture.

What’s the discount here? 💵

Large customers often ask for discounts. Tugce believes it should be dependent on a few things.

Volume: Larger the volume, the deeper the discounts. “Founders can give their customers discounts to make it at a per-unit cost, which they can afford,” says Tugce.

Competitiveness of the market: If the next alternative is cheaper or the next best alternative is a better product, but maybe only slightly more expensive. Give discounts.

The purchasing power of the region: Customers in India, for example, are going to have a different purchasing power than the customers in Canada.

Sometimes discounts are also about the culture. “In some cultures, you kind of have to give a discount to close the deal. Like to be in good faith,” she says.

Keerthi asks founders to go deeper into how the company acquired the customer in the first place.

“If the customer came to you directly, you perhaps would want to give a deeper discount,” she says.

If the customer came through system aggregators or resellers, companies could shave a small price off.

But also look at how competitors discount. That could help companies find the sweet spot.

So I think that's another way of doing discount structures. In addition to all the different strategies at play.

What goes up, will go up again

But life doesn’t end once you get a customer to sign up. It’s also about retention. And when the next billing cycle comes around, sometimes, a year later, the conversation about raising prices becomes important.

Keerthi says founders need to take a step back and ask themselves, “What is the intention there to increase prices?”

Is it to win market share or chase a specific market or increase revenue? That is the base to devise a strategy.

Tugce believes raising prices is about the customer and the position the company holds in the market.

Let’s look at it this way. “If founders were to plot their perceived value to their perceived price, and if the two are lining up, the company is in a good spot,” she says. Now, should you raise prices?

Yes, founders can raise prices to get to a point where value vs price aligns. But does that hinder business?

“You have a certain growth rate that you're achieving. Is that price increase going to throw you off of that growth rate curve that you want to be on?” Tugce asks founders to ask themselves.

But on the flipside. “If their competitors are doing better, and their perceived value is just as much or maybe a little higher, maybe a little lower, but their perceived price is a lot lower, things get tricky.”

She explains that founders are then at a point in which they can’t increase prices because the market thinks their product is already a little expensive.

“They think your competitors are bargained,” she says.

Build in an escalator clause, she advises. What that means is you have some sort of an adjustment in the contract that says that next year your prices will increase, say, 3%.

Generally speaking, companies don't really switch for smaller percentages of price increases.

What Together has been up to ✍🏽

A few things we’d like to share with you.

It’s time to move to the US: Founders across the country are waking up to the opportunity of setting up a base in the US. It helps them acquire customers. But before founders pack their bags, you need to build an ecosystem and even understand the mechanics of serendipity. You should check out Avinash’s very interesting post.

Sector Tear-downs: Want to understand one of the fastest growing sectors in SaaS. Here is a breakdown of the Salestech space by Manav.

A little social media popcorn 🍿

Customer service can set companies apart from their competitors. An interesting thread.

That’s it from us for the month. If you believe you’ve got an idea that we need to hear, write to us at hello@together.fund.

We’ve got an exciting guest lined up for next time. Until then, stay safe, and let’s build Together.

Great read 🙌

Good read! Thanks for sharing 🙌